Renting Senior Housing: A Step-by-Step Guide to Affordable Leases

Outline:

– Understanding affordable housing types: low-cost senior apartments, 1-bedroom rentals, and senior living communities.

– Smarter “near me” searches: local networks, digital tools, and timing strategies.

– Budgeting for total cost of occupancy: beyond rent to utilities, fees, and services.

– Eligibility and applications: documentation, income limits, credit, and waitlists.

– Touring, comparing, and next steps: checklists, questions, and confident decision-making.

Low-Cost Senior Apartments vs. Low-Cost Senior Living: What’s the Difference and Why It Matters

For anyone typing “low cost senior apartments near me” into a search box, the results can blend together: apartments, communities, even care settings. Understanding the differences helps you match needs with budgets. Low-cost senior apartments usually refer to age-restricted, independent-living residences designed for older adults (often 55+ or 62+) who live independently. These may be market-rate or income-restricted, with eligibility tied to household income relative to the area median income (AMI). Common thresholds include 30%, 50%, or 60% of AMI, and some properties set rents using formulas linked to those brackets. In contrast, low-cost senior living communities may include additional services such as meals, social programming, or transportation. While not medical facilities, they’re structured to reduce daily burdens and foster community—often for a modest service fee layered onto rent.

To visualize the spectrum, think of three lanes on the same road. Lane one: traditional apartments with age restrictions, priced either at market level or via income-based rules. Lane two: income-restricted senior housing supported by housing programs that lower monthly costs for qualified renters. Lane three: service-enriched senior living communities where the base rent covers the unit and shared amenities, and optional add-ons improve day-to-day convenience. For many households, the right choice is the lane that balances monthly costs with safety features and social connections.

Features typically seen in senior-focused properties include:

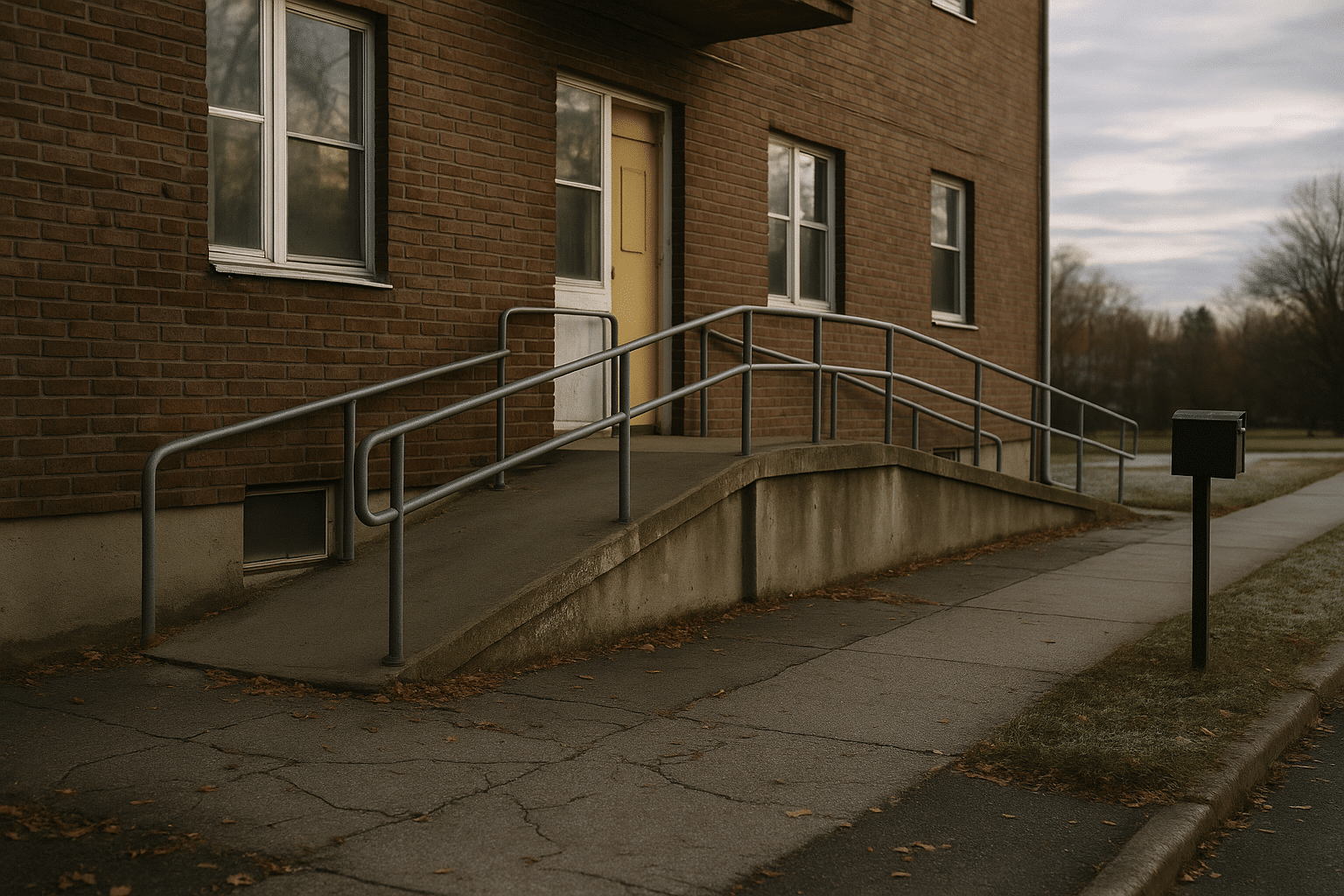

– No-step entries and elevators in multi-story buildings

– Wider doorways, grab bars, and non-slip flooring

– Emergency pull cords or call systems

– Community rooms, on-site laundry, and accessible outdoor spaces

– Proximity to transit, clinics, and grocery options

If you live independently and prefer maximum control of your budget, low-cost senior apartments can be a strong fit. If you want structured activities, light services, and a built-in social network, senior living communities might deliver extra value. There’s no one-size-fits-all answer; instead, align your goals with the level of support you actually use, not features you’ll pay for but won’t need. This clarity reduces surprises later and keeps monthly costs predictable.

Apartments Near Me for Rent: Smarter Local Searches for 1-Bedroom and Senior-Focused Options

Searching “apartments near me for rent 1 bedroom” can return hundreds of results; the trick is guiding the search to serve your needs. Start by defining your target radius in miles or minutes, using a travel-time mindset. If weekly appointments or favorite stores set your routine, map from those anchors and note transit lines, sidewalks, and traffic patterns. Next, refine filters: age-restricted communities if you qualify, accessibility features if needed, and cost ceilings that reflect your true budget. Consider weekday and weekend availability; some managers post updates on a set schedule, and a timely call can surface units before they’re fully advertised.

Local networks are a powerful and often overlooked search tool. City and county housing portals, senior centers, and nonprofit housing counselors maintain up-to-date lists of income-restricted and age-restricted properties. Community bulletin boards, faith-based organizations, and neighborhood associations can alert you to quiet vacancies that never hit the big listing sites. When you find a promising lead, call the manager, ask about upcoming turnovers, and request an application packet—even if the unit you want isn’t available yet. Building a relationship early can place you in the front row when the right apartment opens.

Tactics that save time and reduce stress:

– Use specific phrases such as “62+ 1-bedroom,” “income-restricted senior,” or “elevator building 1-bed” to refine results

– Keep a simple spreadsheet tracking addresses, rents, fees, eligibility rules, and contact dates

– Drive or walk the neighborhood at different times to check noise, lighting, and street activity

– Ask about realistic wait times; some income-restricted properties maintain lists that move seasonally

– Set a follow-up reminder every 10–14 days so you remain top of mind without overwhelming staff

For rural areas, widen your search radius and contact regional housing agencies that cover multiple towns. For dense urban zones, focus on micro-neighborhoods where amenities cluster and transit is frequent. Either way, pair online sleuthing with old-fashioned phone calls. Listings are snapshots; a conversation reveals pet policies, upcoming maintenance, or rent promotions that aren’t visible online. The result is fewer dead ends and a clearer path to the door that fits your life.

Budgeting Realistically: Total Cost of Occupancy for Seniors and 1-Bedroom Renters

Affordability is more than the sticker price. Total cost of occupancy (TCO) includes rent plus utilities, fees, services, and the small expenses that add up. A practical benchmark used by many housing programs is to keep rent near 30% of gross monthly income, but your comfort zone might vary based on health costs, transportation, or debt. Start with a monthly snapshot, then stress-test it for seasonal changes like heating in winter or higher electricity use in summer.

A sample TCO for a modest 1-bedroom might look like this:

– Rent: $950–$1,300 (varies widely by region and building type)

– Electricity and gas: $60–$140 (climate and insulation affect this)

– Water/sewer/trash: $0–$60 (sometimes included in rent)

– Internet: $35–$70 (basic plans often suffice)

– Renter’s insurance: $12–$20 (small cost, big protection)

– Transportation: $40–$120 (transit passes, rideshares, or fuel)

– Laundry and parking: $10–$90 (coin machines or on-site fees)

– Misc. building fees: $10–$40 (package lockers, amenity access)

For seniors weighing low-cost senior living communities, ask how services are bundled. A slightly higher rent can still be a win if it reduces separate expenses. For example, a community that includes:

– Weekly activities and social events (offsetting entertainment costs)

– Transportation to groceries or clinics (reducing rideshare or fuel)

– Maintenance and snow removal (eliminating unexpected bills)

Guardrails for peace of mind include a modest emergency fund and a plan for annual increases. Many leases permit adjustments after the first term; ask for a written estimate of typical year-over-year changes. If your income is fixed, such as a pension or retirement benefit, capture the exact deposit dates and align due dates accordingly. Where eligible, consider income-restricted units or vouchers that tie your rent to a percentage of income, helping stabilize housing costs even when market prices shift. The goal isn’t just moving in—it’s staying comfortably housed through every season.

Eligibility, Applications, and Waitlists: Clearing the Paper Trail Without the Headache

Application success is part organization, part timing, and part persistence. Age-restricted senior apartments commonly require proof of age (55+ or 62+), while income-restricted options verify household size and income against local AMI thresholds. Many landlords look for steady income and a reasonable record of on-time payments. Credit checks and background screenings are standard; if you have a thin or bruised credit file, written explanations and strong references can help contextualize the story. The objective is to present a clear, complete, and tidy packet that makes approval easy.

Prepare a ready-to-send folder that includes:

– Government-issued ID and proof of age (if applying to senior-only housing)

– Proof of income: recent statements or award letters

– Two to three references: prior managers or community leaders

– Documentation for any subsidies you use

– A brief cover note explaining move-in timing and any special needs (such as first-floor or elevator access)

Income-restricted communities may request additional forms to document eligibility. Be ready to verify assets, medical expense deductions where applicable, and household composition. If you anticipate a future change in income, disclose it early so the property can determine whether you’ll remain eligible. Waitlists are common, and many are managed in a first-come, first-served order with priority categories, such as local residency or accessibility needs. Ask how the list works, how often it moves, and whether a response is required to remain active; missing a mailed update can bump your name off the list.

If an application is denied, request the reason in writing and ask whether you can cure the issue, such as providing a document that was missing. Fair housing rules prohibit discrimination on protected grounds, and properties must apply criteria consistently. You can strengthen an application by offering a slightly higher security deposit where permitted, presenting a co-signer in rare cases, or documenting a record of consistent rent payments. Above all, keep a calm cadence: apply to multiple properties, track follow-ups, and keep your folder current so you can respond immediately when a unit becomes available.

Touring, Comparing, and Next Steps: A Practical Conclusion for Budget-Minded Renters

Tours are where the listing becomes real. As you walk the hallways, imagine a week in your life: carrying groceries, using the laundry, meeting neighbors, and navigating the elevator at busy times. Measure spaces that matter—a walker or compact scooter needs turning radius, and a 1-bedroom should comfortably fit your bed and a favorite chair. Listen for ambient noise, examine stair edges and railings, and step outside to gauge evening lighting. If possible, tour at two different times—midday and evening—to catch patterns that a single visit might miss.

Use a simple comparison checklist:

– Access: curb cuts, ramp slope, elevator reliability, doorway width

– Essentials: grocery, pharmacy, and transit within a comfortable distance

– Safety: lighting, sightlines to entrances, and maintenance response times

– Comfort: heating/cooling performance, window seals, and water pressure

– Lease clarity: rent, included utilities, renewal terms, and fee schedules

Before signing, read every clause out loud. Confirm whether water, sewer, and trash are included; clarify pet rules and deposits; and ask about rent adjustment timing after the initial term. If you’re weighing low-cost senior living versus a standard 1-bedroom, put numbers side by side but also weigh the less tangible benefits—social programming, wellness checks, or transportation that reduces outside spending. A slightly higher rent can be the more affordable choice once those savings are counted. Conversely, if you thrive on independence and already have nearby support, a straightforward age-restricted apartment might keep costs lean.

Conclusion: Affordable housing is a journey, not a sprint. By understanding the landscape (senior apartments versus service-enriched living), running smart “near me” searches, budgeting for total occupancy, and mastering the application process, you give yourself agency over both costs and comfort. Choose the place that aligns with your daily rhythms and long-term plans, and let your new front door open to stability, community, and the quiet satisfaction of a lease that truly fits.